Risk Management with Online Prop Firms

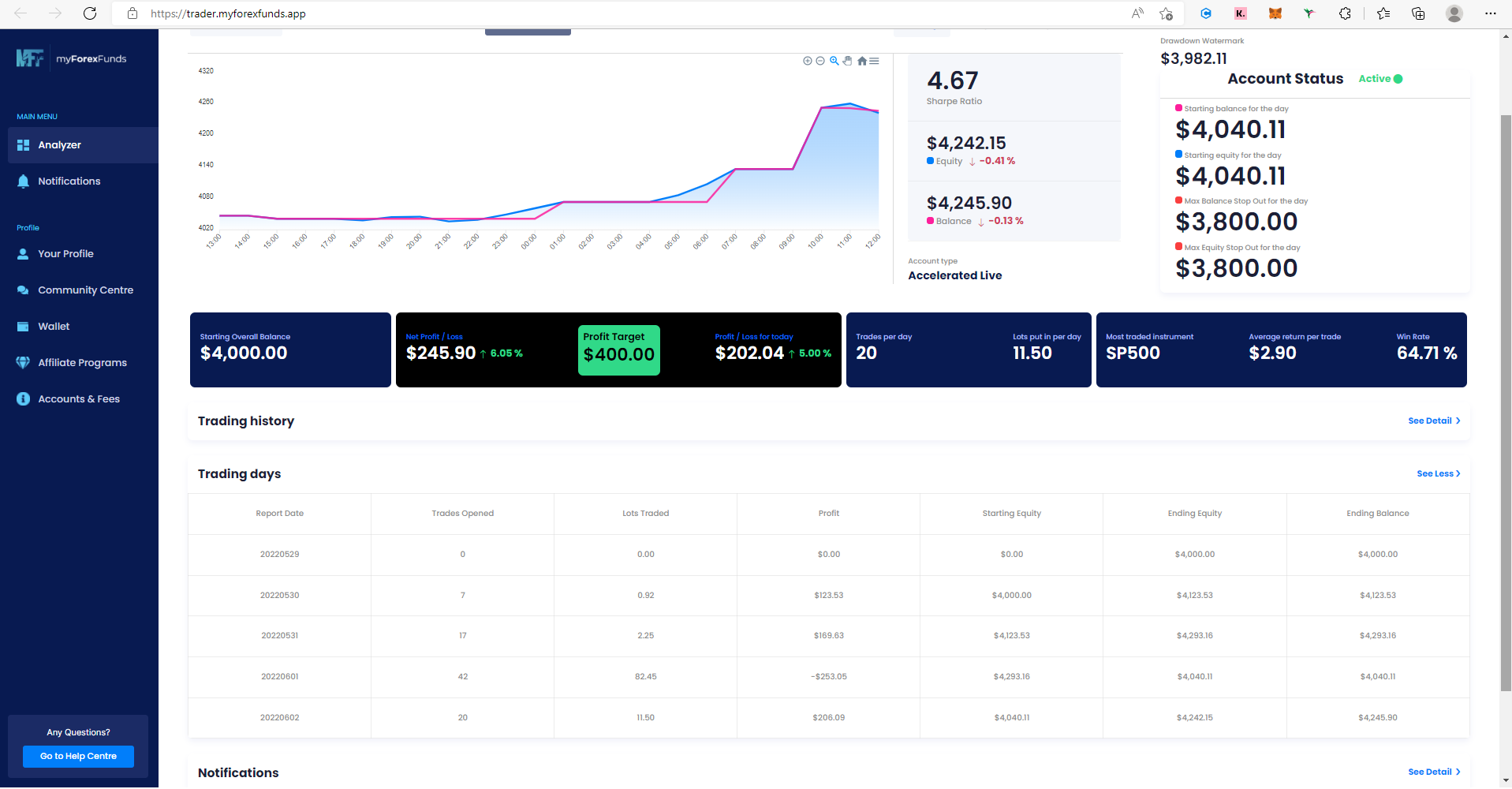

Risk Management at Online Prop Firms Risk Management at Online Prop Firms Trading with online prop firms can be an exciting and potentially lucrative way to make money in the financial markets. However, with the potential rewards come potential risks, and it’s important for traders to implement a sound risk management strategy in order to protect their capital and maximize their chances of success. In this article, we’ll explore some of the key considerations for risk management when trading with online prop firms. Ways to Manage Risk When trading with online prop firms, it’s important to have a risk management strategy in place to help protect your capital and minimize potential losses. Here are some key ways to manage risk: Strategy Description Define your risk tolerance Determine how much risk you’re willing to take on in your trades, and use this information to guide your position sizing and risk management…

The 10 Best Instant Funding Prop Firm Accounts (Included: Promo Codes!)

This guide covers best choices of instant funding prop firm accounts. We look at earnings, scaling, profit and rule fairness.

Prop Firm Review – FTUK

This is a UK prop firm offering up to £4.4 million in funding to traders. Check out our review now for exclusive promo code!

The 5%ers Bootcamp Challenge – Complete Guide (Including Earnings!)

This is a guide for traders wanting to take on the 5%ers bootcamp challenge. It includes information on the challenge, trading, data and more!

Trade the Pool Review

Trade the pool offers funding to day traders in the stock market.

5 Prop Firm Challenges under $100

If your low on cash, or just looking to get starting trading with a prop firm, check out these 5 low cost options.

5 Ways to get a free prop firm challenge (Updated)

No money to buy a prop firm challenge? Or not ready to invest in one yet? Check out this post for options available to get started trading without spending a penny.

What is a prop firm?

If you dont know what a prop firm is or if you just want to know a bit more, check out our informative guide here.

Prop Trading Review – SurgeTrader

This prop firm offers huge accounts from the get go, all the way up to $1 Million. They only require a single phase challenge with no minimum days. This firm would suit an experienced trader who wants large capital fast.

Prop Firm Review – FTMO

FTMO are often regarded as the best in the industry; They designed the standard 2 phase challenge model. This prop firm would suit those who want a tried and tested company with a great reputation.